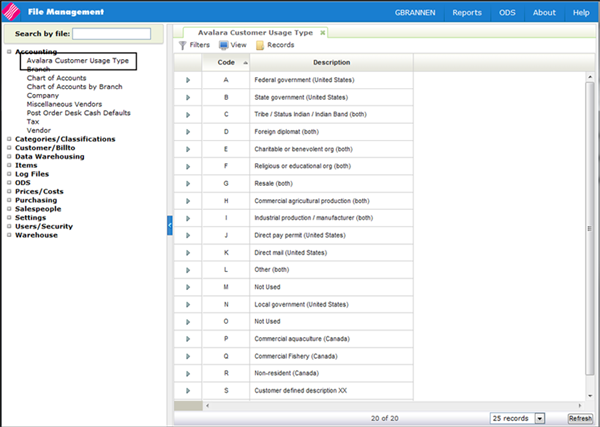

Avalara Customer Usage Type

The Avalara Tax calculation integration is only available in Navigator. It is used in the following parts of the system:

- Navigator Orders: Customer Order, Quote, Direct Ship, Credit Order for Sales and Use Tax

- Navigator Invoicing for Sales and Use Tax

- Navigator Credit Manager

- CMS / EDI - 850 - Order Creation and 810 Invoices

- Decor24 - Order Creation and Display

- Sales Portal - The Tax field in several locations shows the Avalara tax calculations.

- Selection Sheet Manager - Avalara tax calculation is enacted during Order Creation.

Description: Implement Avalara AvaTax for calculating tax on customer orders and invoices.

Reason for Change: Simplifies tax calculation.

When this functionality is turned on and set-up, the 3rd party Avalara AvaTax is automatically and seamlessly used for tax calculations.

After Avalara has been activated, via SET 3, the file Avalara Customer Usage Type is displayed in File Management.

The file comes with 18 pre-loaded entries; as shown above. The Codes (A-R) cannot be changed. However, the descriptions can be updated.

These codes determine if an order or order line is tax exempt.

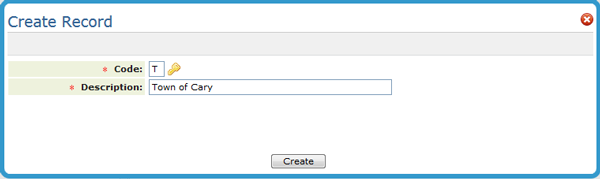

To create a new record, click Records and then select Create.

Keep in mind that the new code also needs to included in the Avalara portal.